Payment Report

It's important to note that one invoice equals one payment report run. So if you were, for example, to create and include two jobs across two separate days that include two fees and expenses and you include them in one payment report run. They will be included as one invoice submission.

Fees and Expenses / Two Jobs / One Payment Report.

Fees and Expenses / Two Jobs / One Invoice Submission.

If on the other hand you have two jobs across two different days. And two separate expenses and you were to include one of those jobs in a payment report and the second job in a second payment report run and then the expenses as a third payment report run. That would result in three different invoices being submitted.

Three Payment Reports / Three Invoices

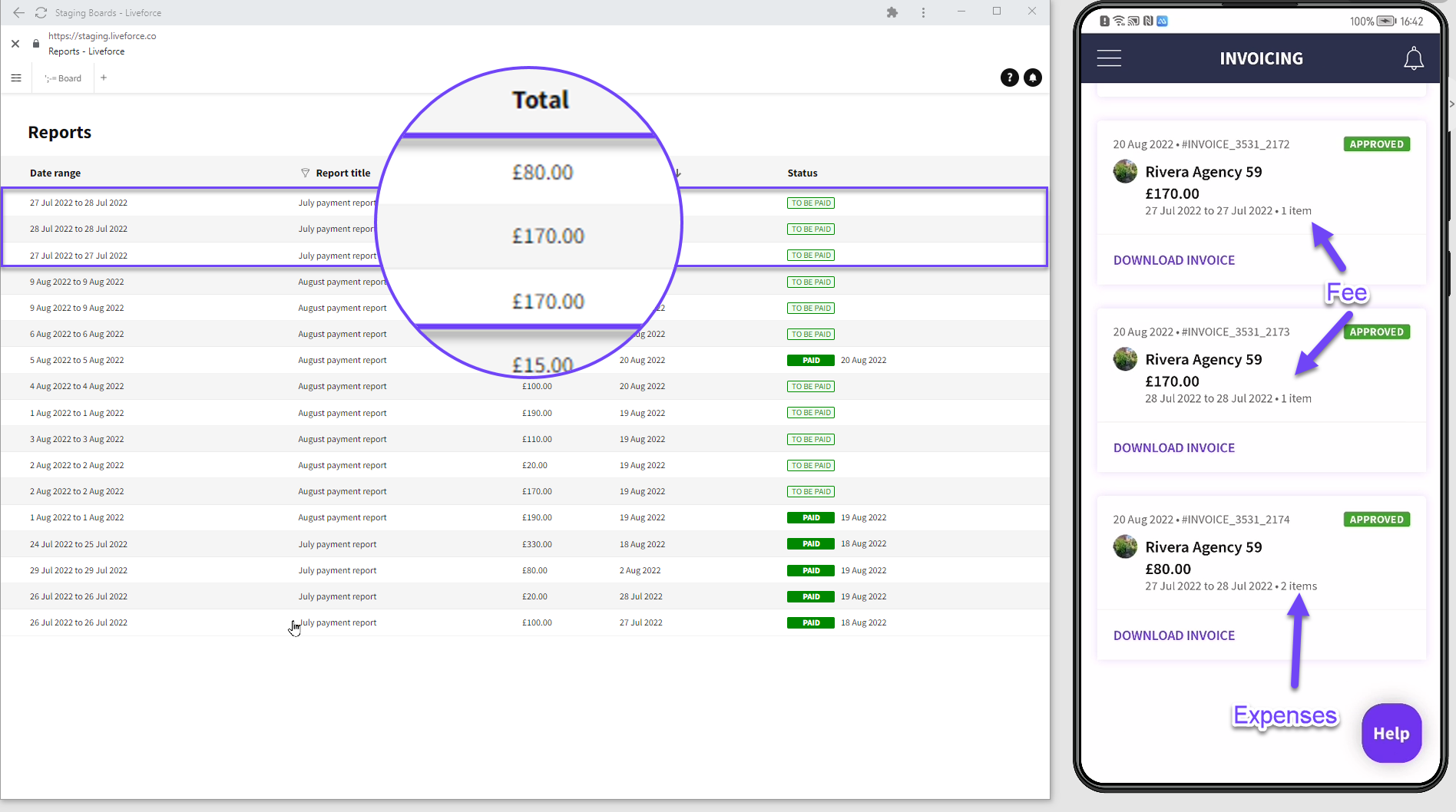

So it's really important to know that an invoice equals expenses and fees included in a payment report run.

Statuses

With invoices, their payment status is directly related to the payment status that is set up in the payroll section. So if an item is set as paid within the pay reports section and has been included in the pay run it will be marked as paid. The invoice will be marked as paid within the invoices summary.

Invoice Status.

The main thing to understand about invoices is that invoices and payment runs are linked together. So if one is paid the other will then be showing as paid.